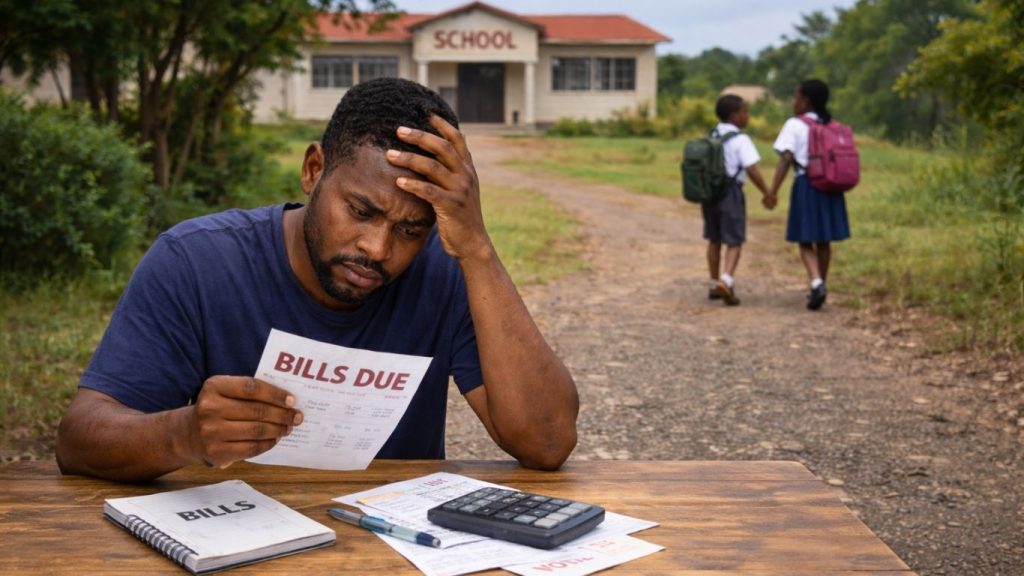

January in Kenya has a reputation that needs no introduction. The festivities are over, wallets are thin, and reality hits hard. Rent is due, businesses are slow, and worst of all, schools reopen. According to the Ministry of Education school calendar, January marks the official reopening period for most Kenyan schools. For many parents, this season is not about fresh beginnings but about sleepless nights, unanswered calls from school administrators, and the silent fear of failing their children.

The pressure of school fees in January is relentless. Unlike other bills, school fees come with deadlines that do not care whether your business slowed down in December or your salary was stretched by holiday expenses. This is where a logbook loan quietly becomes a financial lifeline for parents who refuse to let January break them.

Why January School Fees Pressure Hits Kenyan Parents Hardest Without a Logbook Loan

January is unique because multiple financial demands collide at once. December often drains savings through travel, family obligations, and festive spending. By the time January arrives, income has not fully stabilized, yet expenses multiply. School fees alone can run into tens or hundreds of thousands of shillings, payable immediately.

Many parents find themselves asset rich but cash poor. They may own a vehicle that supports their livelihood, yet they lack liquid cash at the exact moment schools demand payment. This is the gap that a logbook loan fills, especially when traditional bank loans move too slowly or require lengthy approval processes that do not match school reopening timelines.

A logbook loan allows parents to access funds using their vehicle as security while continuing to drive and earn. Instead of selling a car or borrowing informally at high risk, parents maintain control over their lives while solving an urgent problem.

How a Logbook Loan Turns a January Crisis Into a Manageable Solution

The emotional weight of school fees goes beyond money. It affects family harmony, children’s confidence, and a parent’s sense of responsibility. No one wants to send a child back to school late or have them sent home repeatedly due to unpaid balances.

A logbook loan offers speed and dignity. It respects the urgency of January and acknowledges that parents need solutions that work in real life, not on paper. With proper structuring, the loan aligns with income flow rather than creating another financial trap.

At Phoenix Capital, the focus is not simply lending money. The approach is understanding January realities. Parents need funds quickly, repayment terms that make sense, and transparency that removes fear. When handled correctly, a logbook loan becomes a bridge, not a burden.

What Makes a Logbook Loan From Phoenix Capital Different in January

Not all lenders understand the emotional and financial pressure parents face in January. Some exploit urgency through hidden charges or rigid repayment terms. Phoenix Capital takes a different approach by recognizing that January stress is temporary, but financial damage can be long lasting if handled poorly.

Here is what parents typically value when choosing a logbook loan during the January school fees season:

- Speed of approval that matches school reopening timelines

- Fair valuation of the vehicle to unlock meaningful funds

- Clear repayment structures that align with income patterns

- Continued use of the vehicle to support daily livelihood

- Transparency that removes fear and confusion

This single decision often determines whether January becomes a recovery month or a financial nightmare that spills into the rest of the year.

A Logbook Loan Is Not About Desperation, It Is About Strategy

There is a harmful narrative that borrowing in January signals failure. In reality, strategic borrowing can protect assets, relationships, and opportunities. Selling a vehicle to pay school fees may solve a short term problem but create long term hardship. Borrowing informally may lead to damaged relationships or predatory terms.

A logbook loan done responsibly allows parents to stay productive while meeting obligations. It is a calculated move, not an emotional one. When structured through a trusted lender like Phoenix Capital, it becomes a tool for stability rather than stress.

January is not the month to gamble with unregulated lenders or rushed decisions. It is the month to choose solutions that preserve dignity and momentum.

Choosing the Right Logbook Loan Partner Can Define Your January

The difference between relief and regret often lies in who you trust. A good logbook loan partner understands that parents are not looking for luxury. They are looking for peace of mind, continuity, and a way to keep their children in school without collapsing financially.

Phoenix Capital positions itself as a partner during the hardest month of the year. By focusing on clarity, speed, and respect, the company helps parents regain control when everything feels overwhelming.

January will always be demanding. School fees will always come due. But stress does not have to be the default response. With the right logbook loan, parents can turn January from a season of panic into a season of smart decisions.

APPLY NOW: Logbook Loan